Get the free form197aq - adem alabama

Show details

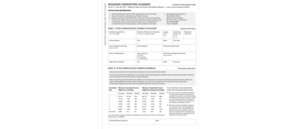

ALABAMA DEPARTMENT OF ENVIRONMENTAL MANAGEMENT AIR DIVISION AIR PERMIT APPLICATION FOR GASOLINE DISPENSING FACILITIES FACILITY NUMBER: DO NOT WRITE IN THE ABOVE SPACES -----------------------------------------------------------------------------------------------------------------------PLEASE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form197aq - adem alabama form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form197aq - adem alabama form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form197aq - adem alabama online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form197aq - adem alabama. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

How to fill out form197aq - adem alabama

How to fill out form197aq:

01

Start by carefully reading the instructions provided on the form. Make sure you understand all the requirements and information needed.

02

Fill in your personal information in the designated sections. This usually includes your full name, address, contact number, and any other identification details requested.

03

Provide the necessary details specific to the purpose of form197aq. It could be related to taxes, employment, or any other specific area. Ensure that you provide accurate and up-to-date information.

04

Double-check all the entered information for any errors or omissions. It is crucial to review the form thoroughly to avoid any potential complications or delays.

05

Sign and date the form as required. This step is usually important for verification purposes. Follow the provided instructions on where to sign and how to indicate the date.

06

Make copies of the completed form for your records. It is advisable to keep a copy of the filled-out form for future reference and reference.

Who needs form197aq:

01

Individuals who are applying for a specific type of license or permit may need to fill out form197aq. This form could be required by local government agencies or regulatory bodies for various purposes.

02

Business owners or organizations may also need to complete form197aq for specific compliance requirements or to seek certain approvals.

03

Individuals or entities involved in financial transactions, such as banks or investment firms, might require form197aq to gather necessary information or authorization.

Please note that the specific requirement for form197aq may vary depending on your jurisdiction or the purpose for which it is needed. Always refer to the instructions provided with the form or consult the relevant authority for accurate guidance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of form197aq?

Form 197AQ is a specific form used by government entities in the United States, often by state or local agencies, to request information related to the number of employees and the amount of wages paid by employers. The purpose of this form is to gather data that can be used for various purposes, such as determining unemployment insurance rates, assessing the economic health of a region, or tracking employment trends. It is used to collect essential information about the workforce and compensation levels within a particular jurisdiction.

What is form197aq?

There is no specific information available about a form197aq. Can you please provide more context or clarify your question?

Who is required to file form197aq?

Form 197AQ is not a standard tax form and does not exist. It is possible that you may be referring to a specific form or requirement in a particular jurisdiction or context. Can you provide more information or clarify your question?

What information must be reported on form197aq?

Form 197AQ is a form related to the reporting and filing requirements for information concerning entities claiming exemption under section 501(a) of the Internal Revenue Code. While I couldn't find specific information about Form 197AQ, the following is an outline of the information generally required to be reported on such forms:

1. Entity Information: The form would require the reporting of basic details about the entity claiming exemption, such as the legal name, mailing address, employer identification number (EIN), and a description of its activities.

2. Exemption Claim: The form would likely ask for information regarding the type of exemption the entity is claiming, such as whether it is seeking recognition as a charitable organization, social club, religious organization, etc.

3. Organizational Structure: The form may require details about the entity's organizational structure, including the date and place of incorporation, governing document information (e.g., articles of incorporation, bylaws, trust agreement), and information about any related organizations or affiliates.

4. Financial Information: The form may ask for financial information, such as annual revenues, sources of income, and a breakdown of expenses.

5. Compensation and Business Transactions: The form may inquire about compensation arrangements for officers, directors, and key employees, as well as any significant business transactions or relationships between the entity and its officers, directors, or substantial contributors.

6. Public Support: If the entity claims public charity status, the form may require information on its sources of public support, such as contributions, grants, and membership fees.

7. Compliance and Activities: The form may inquire about the entity's compliance with the tax-exempt requirements, its program activities, and any lobbying or political activities.

It's important to note that the specific requirements may vary depending on the form and the type of exemption being claimed. Consulting the official instructions and regulations associated with the relevant tax form is crucial to ensure accurate reporting.

How can I modify form197aq - adem alabama without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form197aq - adem alabama into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send form197aq - adem alabama for eSignature?

form197aq - adem alabama is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out form197aq - adem alabama on an Android device?

Use the pdfFiller mobile app and complete your form197aq - adem alabama and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your form197aq - adem alabama online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.